Whether your credit rating is marred by late payments, bankruptcy, or collections, a credit repair company like The credit redeemer can help you get it back on track. Here are some steps and things to think about that will help your credit outlook:

The best thing to do is contact Credit Repair Service Florida today because this process doesn’t take too long – usually only about 30 days! And with our help, it could take just a few hours to complete. We’ll make sure everything’s correct on your behalf, so we can work hard to fix those errors and update your reports accordingly.

Review your credit report for any errors. The first step to improving your credit is ensuring that all of the information listed is accurate and up-to-date. If there are errors, it’s time to dispute them with the appropriate bureau and get that situation cleared up. As soon as you know what needs attention, work towards fixing any inaccuracies so they won’t affect your chances of getting a loan or rebuilding your score. Dispute inaccuracies – If you notice discrepancies between your report and the data sources they’ve pulled, then reach out immediately. Some disputes may need more evidence than others to be resolved successfully, but if they are indeed factual errors they will be resolved within a reasonable amount of time. This must happen now before doing anything else!

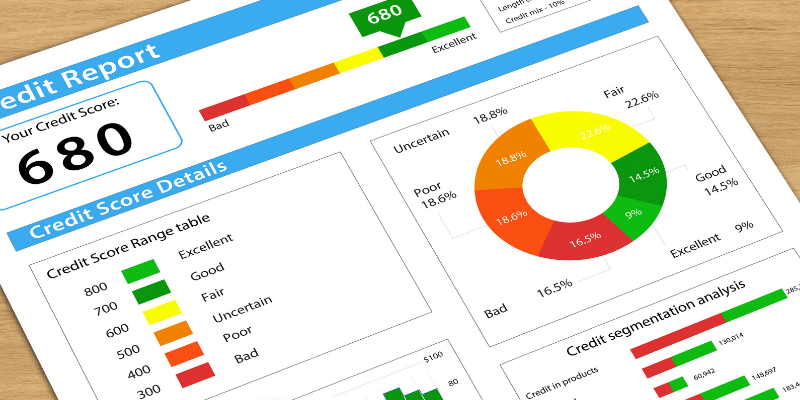

1. Figure Out Your Credit Rating

Get a copy of your annual credit report and review the listing of lenders, unpaid debts, and delinquencies

2. Gather The Documents You Need

Track down copies of statements showing your bad debt, including due dates, balances owed, and monthly payment amounts

3. Calculate How Much You Can Afford To Pay

Decide how much you have available to put towards paying off bad debt each month

4. Set A Compelling Goal For Yourself That Is Likely To Be Achieved

5. Choose Your Plan Of Action And Make It Clear To All Parties Involved

Determine if you will be able to pay off the debt through an online account with that lender or make payments by phone

Once you know what your plan is, make sure it’s communicated with all parties involved so they know when they should expect their money

6. Consider Hiring Professional Help If Necessary

Use this service if you are unsure about whether or not you are taking the right steps or don’t feel comfortable doing this on your own – Look for someone who has been in business for at least five years, has references you can contact, and offers both in-person consultations as well as online chat sessions

1. Pay attention to what is causing your debt and work toward a solution.

2. Establish a repayment plan with creditors if possible, or cut up all your cards so they are not accessible.

3. Keep an accurate record of all income and expenses, and make every effort to spend less than you earn each month.

4. Don’t apply for new lines of credit unless necessary – it’s just too easy for balances not yet paid off to quickly mount up again if bills start going unpaid.

5. Start saving now for emergencies by opening a savings account and depositing some money each week until you have enough.

6. Stop using credit cards – this will prevent any unnecessary spending while also limiting the amount of interest that builds up over time.

7. If your employer offers financial benefits like matching 401k contributions, then do your best to contribute at least 10% to reap the rewards of compound interest later in life.

8. It’s okay to have debts; just don’t let them get out of control!

Some people get themselves into bad situations through no fault of their own and may need to file bankruptcy. Whether this is your first time or a follow-up to an old filing, here are nine tips for preparing.

You must be honest about your assets with yourself and the attorneys handling your case. If any possessions of value have been liquidated for you to keep your head above water financially, let them know immediately so they don’t assume these assets will be used. In some cases, these liquidations may disqualify the possibility of bankruptcy–so it’s important to be upfront about all aspects of your finances ahead of time. Secondly, if there are any property liens attached to what few assets you have left (home mortgages, vehicle loans), make sure to inform the lawyer because he’ll want to make sure those creditors agree to release those liens before handing over your discharge.

If you don’t file a Chapter 13 when there’s more than one creditor involved, then it may be very difficult for you ever come out of debt again because creditors won’t trust that you’re good for future payments; even if by some chance you manage to pay back everything owed without going bankrupt. So if there are more than two creditors involved in your situation, it’s probably best if you take care of them now rather than later–and avoid going bankrupt altogether.

1. Always use a low-limit credit card if available and avoid high-risk, higher-interest cards.

2. If using online shopping, make sure the website is secure, has acceptable privacy policies and doesn’t have reviews or complaints of identity theft or fraud.

3. Try to stick with one major retailer for most purchases, so you’re only at risk for one data breach at any given time.

4. Try not to open up too many new lines of credit too close together; this may cause unnecessary confusion when lenders look at your financials.

5. Keep all information updated on all accounts, such as social security numbers, addresses, contact info, and emergency contacts.

6. Monitor all accounts for unusual activity by logging into each account regularly (daily) or requesting alerts be sent via email or text message notifications.

7. Choose strong passwords that include letters, numbers, and symbols and update them every three months.

8. Use two-factor authentication where possible such as Google Authenticator apps, Touch ID/Fingerprint scanner (iPhone), and Authy App (Android).

9. Consider getting a security freeze which will prevent anyone from accessing your credit without permission until it’s removed by yourself first; these are commonly used after a data breach

10. Get copies of your reports at least once per year

1) Get an organized and reputable credit repair company that you trust. Make sure they know the ins and outs of bankruptcy law or hire an attorney or someone knowledgeable about bankruptcy law. You don’t want to get a company that is unfamiliar with your particular situation because their advice may not work for your specific case.

2) Understand all parts of the bankruptcy process so that when meeting with your debt counselor, it will be easier for them to see what other debts are eligible for discharge. The most important thing is being able to identify what needs repairing!

3) Deal with unforeseen consequences such as defaults, collection calls, and repossession notices while they’re fresh – before they’re buried under more time and stress. Otherwise, it’s too easy just to ignore these setbacks. When speaking to your credit advisor, have a list of questions ready and follow up on any responses that seem unclear. Asking questions shows that you’re actively interested in improving your situation and understanding the process better. Be careful though; some creditors try to lure people into incurring more debt by promising they’ll fix things quickly and easily. There are no shortcuts when it comes to getting out of debt!